Regional financial institution shares fell once more on Thursday simply days after federal officers assured the general public that JPMorgan Chase’s buy of just lately failed First Republic Financial institution would safe the banking sector.

PacWest Bancorp plummeted round 50%, Western Alliance Bancorporation dropped nearly 40%, Zions Bancorporation and Comerica Included declined over 10%. First Republic’s collapse was the second-largest financial institution failure in U.S. historical past and the third main regional lender to fall this 12 months, however President Joe Biden and Federal Reserve Chairman Jerome Powell mentioned the banking system is sound.

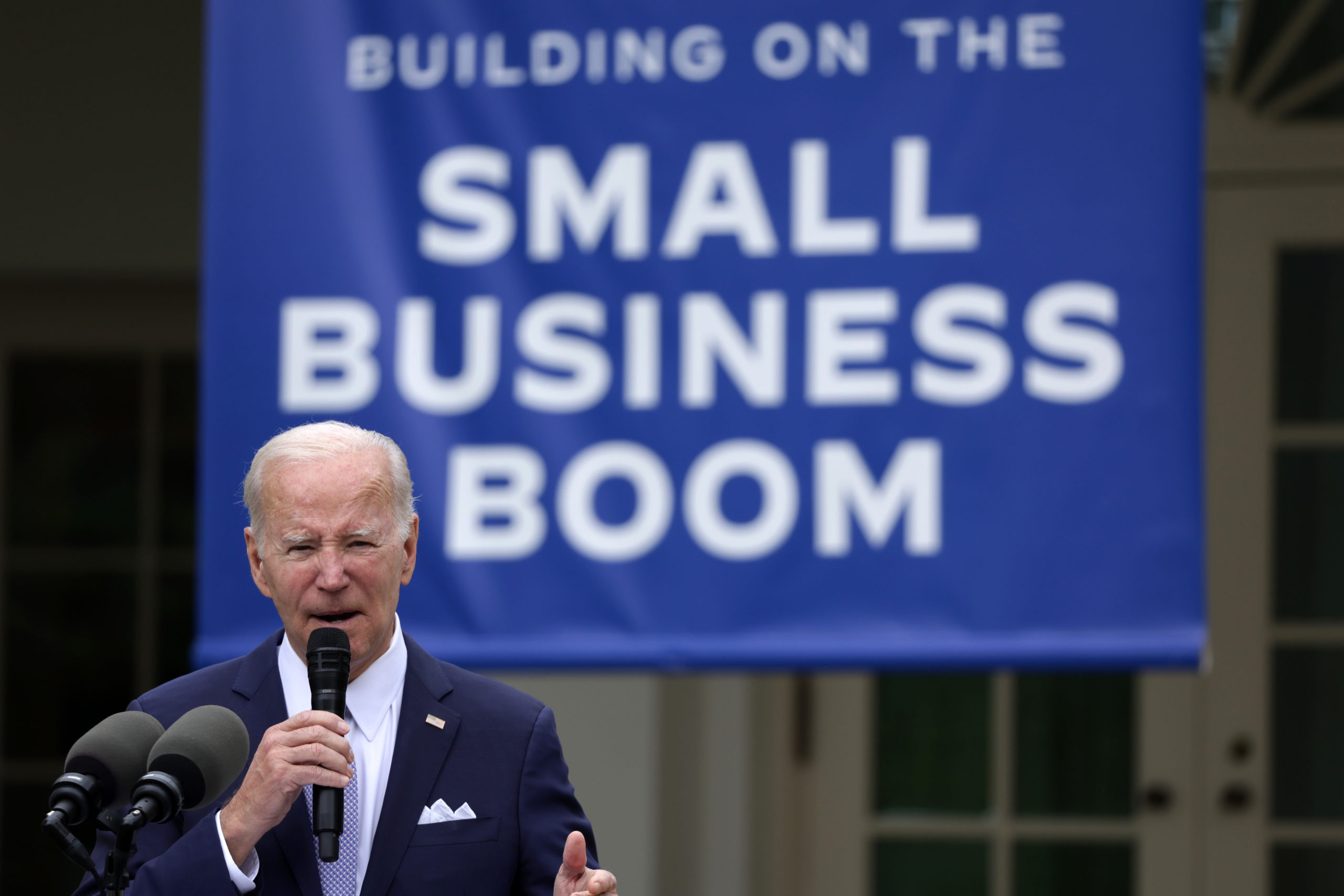

Biden mentioned the FDIC and JPMorgan Chase’s settlement will “make sure that the banking system is protected and sound,” in remarks delivered at a Nationwide Small Enterprise Week occasion on Monday. (RELATED: ‘The US Financial system Is Unwell’: Wall Road Bigwigs Pour Chilly Water On Biden’s Financial Optimism)

WASHINGTON, DC – MAY 01: U.S. President Joe Biden speaks throughout a Rose Backyard occasion on the White Home to mark Nationwide Small Enterprise Week on Could 1, 2023 in Washington, DC. President Biden is internet hosting small enterprise award winners on the White Home to have fun their contributions. (Picture by Alex Wong/Getty Pictures)

Powell mentioned the U.S. banking system “is sound and resilient” in a press convention following the Federal Open Market Committee (FOMC) assembly and ensuing choice to hike charges by 25 foundation factors on Wednesday to the best degree because the 2008 monetary disaster.

“In our final monetary disaster in 2008, we had just a few huge banks go beneath early on after which tons of of regional financial institution failures of their wake,” said Peter St. Onge, analysis fellow in economics on the Heritage Basis. “So on condition that we’ve simply had the second, third, and fourth largest financial institution failures in U.S. historical past, going by historical past we’re due for lots extra.”

Growing rates of interest is usually a downside for regional banks as a result of it makes it extra expensive to carry deposits and lowers the worth of explicit bonds and loans, based on CNBC. These points contributed to the deposit outflow from Silicon Valley Financial institution (SVB) in March, which quickly unfold to Signature Financial institution, inflicting the collapse of each lenders.

The Federal Reserve acknowledged its banking supervisors did not take adequate motion to unravel SVB’s extreme points earlier than its collapse, based on a report by the central financial institution launched on Friday.

America’s 25 greatest banks gained $120 billion in deposits after the failures and rescues of SVB and Signature in March, whereas smaller banks misplaced $108 billion in deposits, based on The Wall Road Journal.

All content material created by the Every day Caller Information Basis, an impartial and nonpartisan newswire service, is on the market with out cost to any professional information writer that may present a big viewers. All republished articles should embrace our emblem, our reporter’s byline and their DCNF affiliation. For any questions on our tips or partnering with us, please contact [email protected].